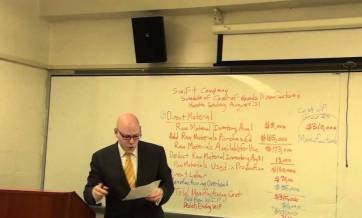

Cost Accounting

Every organization aims for cost controlling and strategic planning to improve cost efficiency and this entire process of recording, examining, summarizing and analyzing the organizations’ expenditure in any process, product, or service and so on is called Cost Accounting. The professional who carries out these responsibilities is called a Cost Accountant. These professionals may work with corporate executives to make a strategic financial plan for an organization or get ready financial reports for tax authorities, stockholders, creditors, and regulatory agencies. After gaining relevant exposure and experience the Cost Accountants usually rise to hold higher designations like; Finance Director, Chief Financial Officer, Financial Controller, Cost Controller and Chief Internal Auditor, and so on.

Role Desciption

The cost accounting professionals are responsible for carrying out cost accumulation responsibilities as a part of the target costing group. It is their responsibility to analyze budgeting, cost management, asset management and performance evaluation for an organization. These professionals collaborate as a part of an executive team to develop a financial plan for the organization. Also these professionals closely work with the corporate executives and heads of the organizations to deliberately develop a plan. They prepare financial reports for tax authorities, regulatory agencies, creditors, and stockholders. They design, analyze and gather data to understand the cost of the business deeds like expenditure on raw material buying, labor, inventory and so on. Also they analyze the real manufacturing cost and prepare periodic report comparing ideal costs to the real production cost. Also they provide reports particularly on comparison that affect the costs and profitability of products or services.

Eligibility

Route to Cost Accounting Profession

| Route 1 | 10+2 in Stream(Commerce Preffered) |

| 8 months Foundation course | |

| 10 months Intermediate course | |

| 15 months of practical training | |

| Final Exam | |

| 3 years of work experience | |

| Route 2 | 10 +2 in any Stream (Commerce preffered) |

| Bachelors in any field other than fine arts / Qualified CAT part 1/ CA intermediate | |

| 10 months Intermediate course for 10 months | |

| 18 months Final course | |

| 15 months of practical training | |

| 3 years of work experience | |

| Route 3 | 10+ 2 in Commerce Stream |

| Bachelors in any field other than fine art | |

| Certified Management Accountant (U.S) |

Significant Statistics

- Exams for Cost Management Accountant degree are conducted by The Institute of Cost Accountants of India (ICAI)

- For entire year the registration for the ICAI course remains open and students willing to appear need to apply at least 6 months before the exam date.

- Candidate must fulfills the education as well experience eligibility to get credited with CMA (US)

- Student must possess fundamental knowledge of subjects like; basic statistics, economics, financial accounting and so on

- Professional experience of regular two years is required

- IMA (Institute of Management Accountants, USA) awards global professional qualification in the form of CMA (Certified Management Accountant)

Pros/Cons

Pros

- The profession has a reasonably good growth potential

- Great scope for financial growth as remuneration and perks are good and continuously growing

- There is a huge demand for Cost Accounting professionals

Cons

- Repetitive and boring work environment

- Long Work Schedule

- Need to qualify certain certifications before launching a career

Leading Professions

View All

ICAS Professionals in Government sector

Indian Cost Accounts Ser...

10.0LPA

Professors or Researchers in Cost Accounting

The Cost Accounting grad...

8.0LPA

Auditors or Internal Auditors

Business organizations a...

5.0LPA

Cost Management Accounts with Banks

Banks hire these profess...

12.0LPA

Forensic Accountant

Forensic accountants spe...

10.0LPA

Cost Controller

Cost controllers are res...

9.0LPA

Management Accountant

Management accountants f...

9.0LPA

Project Cost Estimator

Project cost estimators ...

10.0LPA

CAREER VIDEOS

Career Path

Route 1

4 Steps

Route 2

4 Steps

Route 3

3 Steps

Skills

Recruitment Area

Banking ,

educational institutes ,

Private and Public corporate sector ,

Financial Institues ,

Developmental Agencies ,

Training and Research ,

Service and Public Utility Sector .

Recruiters

Deloitte ,

SBI ,

PNB ,

HDFC ,

Pricewaterhouse Coopers ,

AT Kearney ,

Enrst andYoung .

Explore Colleges

Exams & Tests

Interested? Take the next step for this career

Route 1

- 4 Steps

Route 2

- 4 Steps

Route 3

- 3 Steps

Skills Needed

Exams and Tests

Recruitment Area

Banking ,

educational institutes ,

Private and Public corporate sector ,

Financial Institues ,

Developmental Agencies ,

Training and Research ,

Service and Public Utility Sector .

Recruiters

Deloitte ,

SBI ,

PNB ,

HDFC ,

Pricewaterhouse Coopers ,

AT Kearney ,

Enrst andYoung .