For Students

Careers in Finance- Part 1

Admin Sep 21, 2022 01:32 PM

TAGS

All you need to know about your career path in the finance industry

The finance industry has been growing exponentially in the recent years around the world, extending far beyond the Wall Street niche as we knew it, with thousands of professionals working across various sectors within the finance industry such as accountancy, risk management, investment banking, financial advisory, and insurance.

Although finance can nowadays take many forms, all roles within the finance world come down to one thing – money. Whether it is managing money for individuals, small businesses, corporations, financial institutions, or even the government – those who work in the financial sector work on the valuation of allocation of capital, or to put it simply managing assets or cash.

Taking everything into consideration, if you are thinking of pursuing a career in finance, then calculating an asset’s worth, raising and allocating capital, tracking and predicting changes in the economy, and providing quality financial advice are only a few examples of your regular tasks.

The financial equation: The difference between the Sell-side vs the Buy-side

While finance covers a lot of ground, people refer to finance careers as the Sell-side or the Buy-side. The former side encapsulates the roles that are on the selling side of the financial equation and includes areas such as investment banking, commercial banking, and trading&sales. On the other hand, the latter side is made out of the roles that are on the buying side of the financial equation and includes areas such as asset management, hedge funds, institutional investing, and private equity.

If all the above sound fascinating, then be rest assured that it’s only the introduction. This guide intends to provide you with a holistic overview of the financial industry and the different career paths you can follow. Let’s dive right into it and find out how you can jump start your finance career!

- Investment banking

Investment banking is defined as a ‘special segment of banking operation that helps individuals or organisations raise capital and provide consultancy services to them’. (Economic Times, 2020). Investment banking covers a lot of ground and is considered to be one of the most complex financial mechanisms.But to make this a bit simpler for your, here are the major functions you need to know about:

- Raising Capital & Security Underwriting: Banks act as intermediaries between a company that wants to issue new securities and the buying public.

- Mergers & Acquisitions: Banks provide financial advice to both buyers and sellers on M & A matters such as negotiation, pricing, and implementation.

- Sales & Trading and Equity Research: Banks match up buyers and sellers along the financial equation to facilitate the trading of securities.

- Retail & Commercial Banking: Banks offer traditionally off-limits services including commercial banking.

- Front Office vs Back Office: Back office functions are as critical as front office functions and include areas like financial control, corporate strategy, compliance, risk management, operations and technology.

The work of an investment banker

But if you are still wondering what the daily work of an investment banker looks like, then let us make this a bit clearer for you. As an investment banker, your job is to firstly valuate a company’s or asset’s worth, and secondly to sell that company or asset on the open market.

If you are just starting out as a junior investment banker, then the probabilities are that you will be working on the first phase of the process – which has to about valuation. In order to conclude to an accurate and data-driven valuation, you will need to have a thorough look through the company’s financial statements, related press releases, competitors’ financial performance, and other useful financial metrics. And as you might have imagined you will be asked to develop presentations to summarize the business’ standing as well as your perspective on its valuation.

Yet, as you move to senior investment banking roles, you will start to work on business development which encapsulates building relationships with current and potential clients as well as meeting prospective investors. Remember, the basic business model is built on acquiring, retaining, and growing your customer base.

The life of an investment banker

There is no shortage of disagreement that investment banking is a highly demanding function that, not surprisingly, requires great commitment from your side. Long hours and short breaks (not to say zero breaks)are what you should expect from your career in investment banking. So, if you are considering pursuing a career as an investment banker, then make sure that you are ready to sacrifice many hours from your personal time.

The pay of an investment banker

While the life of an investment banker might be harsh and tiring, it doesn’t come without a reward. Typically, investment bankers at a junior level make a six-figure annual salary depending on the performance of the firm. Not to mention the pay for senior investment bankers which can skyrocket up to $2.000.000. Long hours are not bad after all, right?

2. Private Equity

As its name suggests, private equity firms manage capital that is not listed on a public exchange (or also known as the stock market). But how do private equity firms make money? To put it simply, private equity firms usually invest on behalf of wealthy institutions or even individuals in order to receive a percentage of the profits they generate plus a percentage of the annual fund size.

To achieve great profits, private equity firms are always on the lookout for opportunities hiding major profit potential such as businesses facing shortcomings or deficiencies – which if solved can lead to a large upside. These problems might be in the form of ineffective management, insufficient capital, lack of expertise, or ineffectual capital structure.

Taking into consideration that equity firms are usually not publicly listed and their shares are not traded in the stock market, they are considered to be more flexible when it comes to regulatory issues as they are not required to comply with the stringent regulations that public companies have to.

The work of a private equity firm employee

Private equity firms tend to be smaller when it comes to staff than public companies, which means intense competition for a limited number of positions. Your work as an employee in a private equity firm will depend upon your level within the organization. While in a junior role you will be expected to handle company research, reports, and prospectuses, as you move to senior executive positions you will be responsible for key investment decisions and strategies.

The life of a private equity firm employee

Once you ‘ve landed a job within a private equity firm, then be ready to deal with a dynamic, fast-paced financial environment – in which pressure, responsibility, and accountability will become the new normal.

Although you should expect long hours in general, you should be prepared to work until midnight or even during the weekends if there is a big project coming up. No need to add, that as you climb up to executive roles work hours will keep getting longer and longer.

The pay of a private equity firm employee

But don’t get discouraged just yet - the pay and benefits you will receive will compensate your heavy schedule and workload. Without a doubt, the private equity sector ranks among the highest paying professions in the finance industry – which can mean a six-figure annual salary on average. Not to mention, that this amount doubles or triples in the case of partner roles or leadership roles.

3. Hedge Funds

Hedge funds are investments in public debt and equity markets, such as stocks, bonds, commodities, and currencies. Put simply, a hedge fund is a pool of money taking both short and long positions, buying and selling equities, initiating arbitrage, and more, to generate returns at a reduced risk. As the name suggests, the fund seeks to hedge risks to investors’ capital against the volatility of the market by following alternative investment approaches.

The work of a hedge fund analyst

As aforementioned, hedge funds are investments in various sectors in the financial industry. Usually, a hedge fund firm is only concerned with one of them, specializing thus in the specific sector. There are normally three teams in a hedge fund company:

- Investment Team: The Research/Investment Analysts and Portfolio Managers who come up and evaluate ideas and make investment decisions.

- Trading Team: The Execution Traders who carry out the Investment Team’s strategies and aim for the best price on each trade.

- Middle and Back Office: The back office at a hedge fund consisting of supporting areas such as compliance, operations, accounting, and IT.

Starting your career straight out of university in a hedge fund company usually suggests that you start from a Junior Analyst or Research Associate position. You perform some of the same tasks as full Analysts, such as financial modelling, data gathering, due diligence, idea generation, and monitoring existing investments.But the difference is that you have less independence, and most of your tasks are assigned to you by the Analysts.

The life of a hedge fund analyst

Much like an investment banker, working as an analyst in a hedge fund requires you to devote most hours of the day to your work. Due to the fact that your day-to-day depends on events happening live around the world, keeping up with news and staying informed by reading financial reports is imperative. The hours are still long and stressful, though better compared to investment banking.

The pay of a hedge fund analyst

Most hedge funds are small with about 10 employees and work on average 50-70 hours per week. The long hours in the office along with occasional work during the weekends cashes in at about $500K - $1M annually, even for a junior-level employee, while it reaches the tens of millions of dollars for partners.

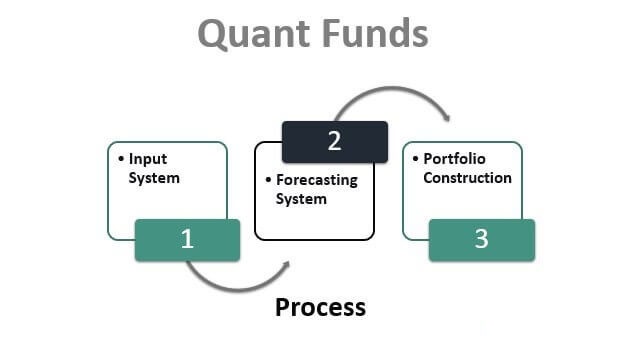

4. Quant Funds

Quant funds are a type of hedge funds responsible for generating sophisticated programs to make investment choices. The reasoning behind this is that there is a predictable pattern or cause-effect behind the movement of publicly traded assets (e.g. stocks, commodities, bonds, and currencies) which is too complex for human intelligence to identify and interpret, so machine learning and artificial intelligence is employed to aid in the identification of these patterns.

The work of a quantitative analyst

A quantitative analyst is a professional who employs quantitative methods to help firms make business and financial decisions. Investment banks, asset managers, hedge funds, private equity firms, and insurance companies all employ quantitative analysts, also known as "quants," to help them identify profitable investment opportunities and manage risk.

Computer software penetrates various stock exchanges, buying and selling shares when prices hit levels the algorithm has predetermined as profitable. While the computer algorithm does the grunt work, it is quantitative analysts who are the brains and come up with these algorithms. The best in the business make their employers millions of dollars on a monthly basis simply by programming algorithms that are fast and efficient enough to find the best trades before their competitors do.

The life of a quantitative analyst

Though quantitative analysts work across a variety of industries, they are disproportionately concentrated in banking and investment centres. Similar to all jobs in this realm, quantitative analysts need to devote a big portion of their day for their job which rarely offers work/life balance. To be successful in a quantitative analyst career, one requires an unflappable work ethic and a rigid commitment to putting in the time and effort for the best possible outcome.

The pay of a quantitative analyst

Quantitative analysts earn six figures on an annual basis, and this is not surprising as most of the people in this field devote a lot of time in their studies and their specialization deems them rare in the industry. There is also a lot of potential for moving up the ranks and reach the 7-figure earnings club, given that you spend a lot of time on work.

5. Sales and Trading

Within investment banking, Sales and Trading (S & T) makes up one of the primary functions that serve the growth and expansion of an investment bank. In simpler words, the Sales & Trading group consists of a team of salespeople that are responsible for calling institutional investors to present a set of ideas or opportunities in the market, as well as traders to execute the deal. This process is known as ‘market-making’.

The work of a Sales & Trading employee

If you are thinking you might be a good fit for the Sales & Trading function, then the majority of your work will be about communicating information effectively between investors and traders in a timely, professional, and precise manner. Investors might range from large institutional investors to individual retail investors, so you should expect to work with investors across various sectors and companies of various sizes.

Therefore, being able to efficiently close deals and build relationships with investors is a large part of the Sales & Trading function. In addition to that, you will also be expected to work with portfolio managers and trading personnel to get timely market information.

The life of a Sales & Trading employee

Ultimately, as a Sales & Trading employee, you will be acting as an intermediary in order to facilitate transactions, and you will usually be eligible for commissions on those transactions. Taking this into consideration, it will be tempting to stay extra long hours to close the deal and make some extra cash. Yet, it’s up to you to make the decision of work-life balance.

The pay of a Sales & Trading employee

The annual salary of an employee in the Sales & Trading industry is significantly lower compared to investment banking or working for a private equity firm. Yet, the majority of S& T positions are performance-based which means that you are – up to an extent – in charge of your own pay. So, if you think you can make a great salesperson, then this job can lead to high earnings!

Search

Latest Blogs

Exploring Opportunities in Emerging Engineering field

Admin

Dec 14, 2024 05:18 PM

Navigating College Majors

Admin

Sep 25, 2024 04:04 PM

Tools for Measuring Strengths For Career

Admin

Sep 25, 2024 03:27 PM

Interested in getting latest updates?

SUBSCRIBE